End-to-end support,

real properties

We guide you to your first property investment or your next one.

Free. No credit card required.

Understand the numbers

See how good real estate investments look. Cashflow projections, tax benefits, total return after selling — know your numbers before you commit to anything.

- Interactive tax & cashflow calculator

- Total return projections (including exit)

- Real financing estimates from banks

- No commitment required

Year 1 tax savings

€8,450

Try it yourself — enter your numbers after creating an account

Prefer a personal introduction? Book a free discovery call

Investment property ≠ your dream home

Location, aesthetics, personal taste — these matter for where you live. For wealth-building, the math is what counts. That's why we're not a mortgage broker.

Property As An Investment

See how real estate investing creates tax advantages and builds wealth over time.

Step 1

Learn How It Works

Watch our 11-minute explainer to understand the fundamentals

A video from Financemate Co-founder Daniel

11 minWhat you'll learn

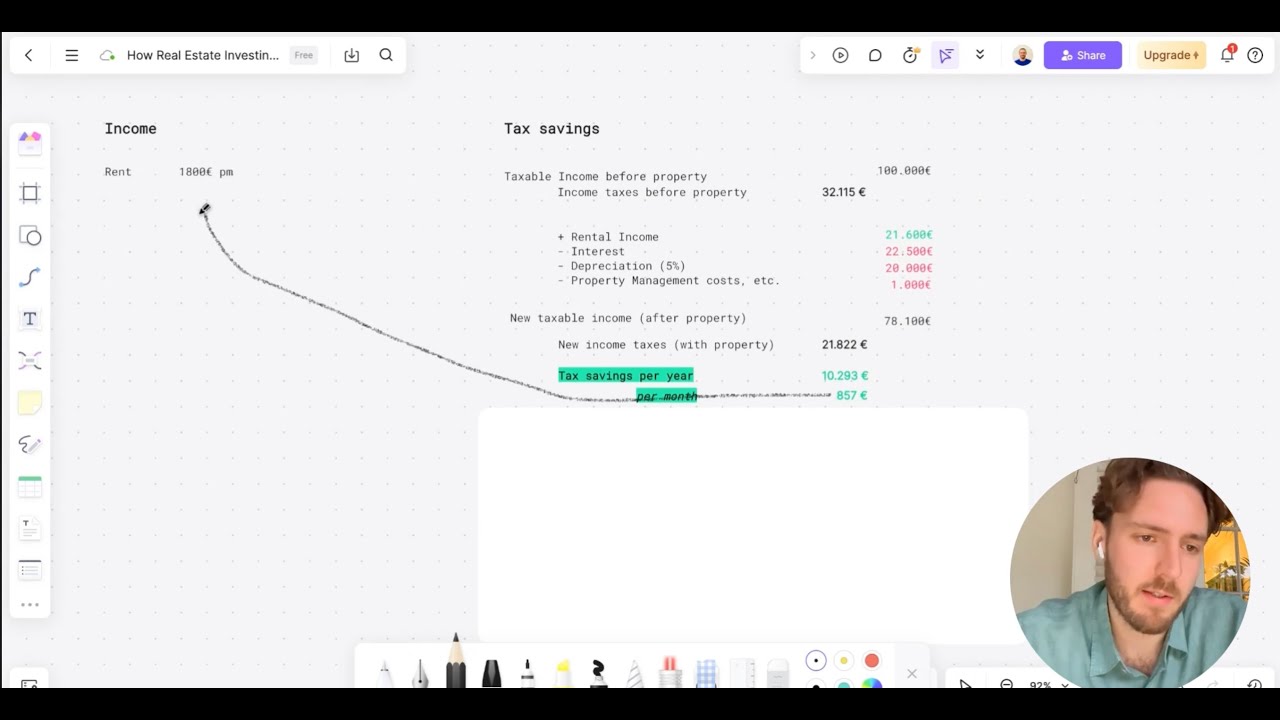

- How real estate creates tax advantages

- How depreciation reduces your tax burden

- Cashflow positive investing explained

Step 2

Calculate Your Tax Savings

Adjust the values below to match your situation

At an annual income of , buying a property worth , with 100% financing at interest, 1.5% repayment and depreciation of 5% degressive, without eligibility gets you this...

Step 3

Simulate Your Long-Term Gains

See what you walk away with after 5-30 years

Based on your €450.000 property with 100% financing...

Everything You Need, In One Place

Real estate investing in Germany is complex. We make it simple — handling everything from education to property management.

End-to-End Support

From first calculator to collecting rent. We guide you through every step — no need to coordinate multiple parties.

No Buyer Commission

Unlike traditional agents who charge 3-6%, we don't charge buyers. Our fee comes from developers.

We Find It For You

No endless Immoscout scrolling. We source and vet properties qualifying for maximum depreciation — you just pick.

English Throughout

English-speaking team, notaries, and documents. No German required to invest confidently.

Financing Sorted

We regularly achieve 100% or 108% financing through banking partners who know our properties.

Property Management

Tax-deductible management included. Tenant admin handled — you focus on receiving rent.

Ready to see how it works for your situation?

No credit card required

Prefer a personal introduction? Book a free discovery call

Don't take our word for it!

Hear it from our clients.

FAQs

Property investing in Germany allows you to offset rental income against depreciation and interest costs, often creating a "paper loss" that reduces your taxable income while you build real equity. Learn more in our Real Estate Glossary.

Real Estate GlossaryMortgage brokers like Hypofriend help you find financing for a property you've already chosen. Financemate is an end-to-end investment service: we help you find investment properties, analyze returns and tax benefits, and handle financing as part of the process. We focus exclusively on investors building wealth, not homebuyers.

See full comparisonNot necessarily. With 100% or even 108% financing (covering purchase price plus closing costs), many investors start with €0-30,000 in cash. Your income and creditworthiness determine your financing options.

In Germany, you can depreciate the building portion of your property (typically 80% of purchase price) over time. New buildings built after 2023 qualify for 3% linear or 5% degressive depreciation, plus potential Sonder-AfA (special depreciation) of 5% per year for the first 4 years.

AfA Depreciation GuideLinear depreciation is a fixed percentage each year (2-3% depending on build year). Degressive depreciation (5%) allows higher deductions in early years, switching to linear when it becomes more favorable.

While higher incomes see larger tax benefits due to progressive tax rates, property investing can be beneficial starting from around €60,000 annual income. The key is positive cashflow after all costs.

We partner directly with developers to offer new-build properties that qualify for maximum depreciation benefits. This means no buyer's commission and properties vetted for investment suitability.

We offer free 15-minute consultations, help you understand your numbers, connect you with financing partners, and provide ongoing support through the purchase process.