See The Math That Makes Real Estate Worth It

Not all properties are created equal. Some save you €5,000/year in taxes. Others save €15,000. We'll show you the difference between buying random and buying smart.

| Metric | Random | FM 5% | FM 5% + Sonder | FM Heritage |

|---|---|---|---|---|

| Depreciation Method | 2% linear | 5% degressive | 5% deg. + Sonder-AfA | Heritage (3 streams) |

| Year 1 Tax Savings | €5k | €10k | €18k | €13k |

| Years 1-4 Tax Savings | €21k | €41k | €70k | €54k |

| 12-Year Total Tax Savings | €63k | €114k | €143k | €153k |

| Year 1 Monthly Cashflow | €-272 | +€149 | +€752 | +€406 |

Based on your inputs: €450k property, €95,000 income (using progressive tax formula)

What This Comparison Actually Shows

Same property. Same purchase price. Same mortgage. The only difference? How much depreciation the property qualifies for. And that difference is €50,000-€80,000 in tax savings over 12 years.

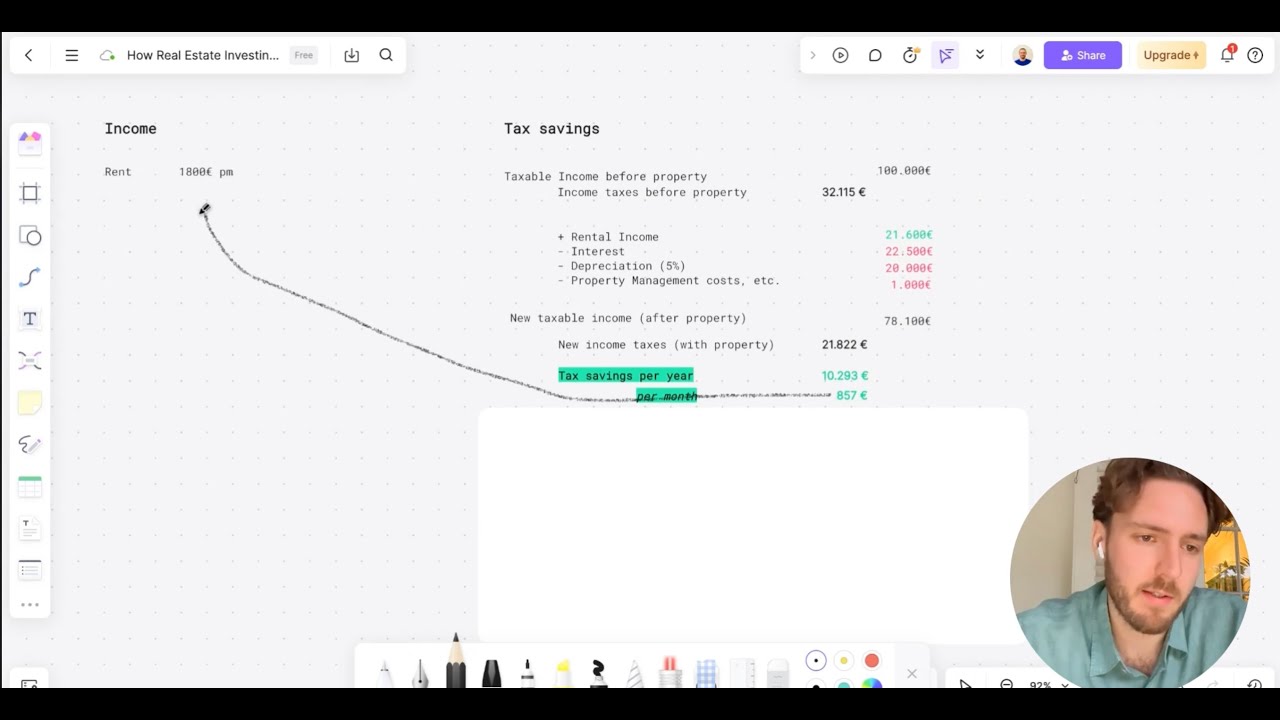

Here's what's happening: A random old building with 2% linear depreciation gives you around €6,000/year in tax benefits. Not bad. But a Financemate property with 5% degressive depreciation? That jumps to €10,000/year. Add Sonder-AfA on top (5% + 5% for the first 4 years), and you're looking at €15,000-€18,000 annual tax savings in the critical early years.

Heritage properties take this even further with three concurrent depreciation streams running simultaneously. That's €20,000-€25,000 in tax savings in year one alone.

But here's where it gets real: Look at the monthly cashflow row. A random property with 2% AfA might be cashflow-neutral or slightly negative. The same property with optimized depreciation? Positive cashflow from month one. The tax savings literally turn a monthly loss into a monthly gain—while you're building equity the entire time.

This isn't just about year one. Those extra tax savings compound over 12 years. The difference between a random property and a heritage property? €70,000-€80,000 in your pocket through tax savings alone. That's before we account for the peace of mind of positive cashflow, the faster equity buildup, and the fact that you can sell tax-free after 10 years thanks to Germany's Spekulationsfrist.

Watch: How Tax Benefits Actually Work

See a step-by-step walkthrough of how depreciation turns tax payments into equity, and why the property you choose makes such a massive difference.

Why Most Properties Don't Qualify

The math works beautifully, but finding properties that qualify for maximum depreciation is the hard part. Most properties on the market are older buildings stuck at 2% linear depreciation. New construction with 5% degressive is rare. Properties eligible for Sonder-AfA? Even rarer. Heritage properties with proper documentation? Unicorns.

This is where Financemate comes in. We maintain a curated portfolio of properties that all qualify for optimized depreciation. Every property in our portfolio is vetted for maximum tax benefits—no random 2% properties. That's why the comparison above isn't theoretical. It's the actual difference between what you'd find randomly vs. what we show you.

📚 Want to understand the math deeper?

- • Read our Tax Strategy Guide for the complete breakdown of how depreciation works

- • Check our Real Estate Glossary for definitions of all terms

- • Use our Tax Calculator to see your exact numbers with your income

Disclaimer: This comparison is for educational purposes only and does not constitute financial, tax, or legal advice. Actual results vary based on individual circumstances, property specifics, tax situations, and market conditions. Consult with qualified tax advisors and financial professionals before making investment decisions. Past performance and projections are not guarantees of future results.